by Lauren Cohen | Oct 27, 2023 | Renewables, Solar, Solar for Good

On Friday, October 13, Temple Beth El, a progressive Reform synagogue located in Madison, set a remarkable example by installing a 102-kilowatt solar array. Full Spectrum Solar installed the array, which is expected to save the synagogue approximately $12,000 annually.

The array will offset 31.5% of their projected annual energy consumption, contributing significantly to their sustainability goals, which are aligned with aspects of their overall mission. For more than 84 years, Temple Beth El has remained dedicated to its vision to create and sustain a vibrant, inclusive, and engaged community that connects individuals from all walks of Reform Jewish.

Affiliated with the Union for Reform Judaism, Temple Beth is the sole Reform Jewish congregation in Madison, providing a welcoming haven for Jewish people to come together and fulfill their spiritual, educational, ethical, social, and emotional needs and expectations.

The decision to install solar panels was not one that was taken lightly. In 2018, the temple established a task force to review investment priorities for its 75-year-old building. Recognizing that their roof offered an ideal space for solar panels, they made necessary improvements to support the longevity of the installation. This solar initiative serves two crucial goals for their community: reducing their carbon footprint and reliance on fossil fuels and lowering their energy costs.

The success of this solar initiative was made possible through multiple funding sources. Temple Beth El was a grant recipient of the Solar for Good program, which supplied them with half of the solar panels required for the project. Additional financial assistance came from the Goodman Foundation, which helped offset the costs of the remaining solar panels. With the passage of the Inflation Reduction Act’s Elective Pay provision, the temple will receive a 30% refund from the federal government, significantly reducing the overall project cost.

The completion of Temple Beth El’s solar array is a testament to their commitment to both environmental sustainability and fiscal responsibility. By harnessing the power of the sun, they are taking strides to reduce their carbon footprint and inspire their community to follow suit. This initiative not only aligns with their vision of inclusivity but also paves the way for a greener and more energy-efficient future.

Temple Beth El’s solar journey serves as a reminder of the importance of collective action to electrify Wisconsin’s energy mix and transition away from fossil fuels. With its newly installed solar array, the organization has not only reduced its carbon footprint but also set a compelling example for others to follow.

by Lauren Cohen | Sep 28, 2023 | Renewables, Solar, Solar for Good

Located in Madison, Wisconsin, St. Dunstan’s Episcopal Church, founded in 1958, has embarked on a notable journey towards sustainability and environmental responsibility. This warm and inclusive congregation, comprising approximately 200 households, places a strong emphasis on creation care, welcome for all, and the full inclusion of LGBTQIA+ individuals. Their recent venture into renewable energy underscores their commitment to their faith and environmental stewardship.

St. Dunstan’s has long been aware of its carbon footprint. In 2016, the church established a Creation Care mission statement, outlining its commitment to nurturing a reverence for the natural world, reducing its ecological impact, and broadening its involvement in environmental initiatives. To this end, the church had previously sourced all its energy through MGE’s shared solar and green energy programs. However, with mounting concerns about climate change, the congregation sought to take more direct action.

In the fall of 2022, St. Dunstan’s Episcopal Church received a grant from RENEW Wisconsin’s Solar for Good program. This initiative supports nonprofits in the state in installing solar arrays, marking the inception of an ambitious effort to generate renewable energy on-site. This decision aligned with the church’s pre-existing commitment to environmental stewardship.

The resulting 29.7-kilowatt solar array, installed by Full Spectrum Solar, consists of 55 panels and is anticipated to offset 75 percent of their estimated annual energy consumption.

Financial backing for the project was a collaborative effort. St. Dunstan’s secured a generous gift from a donor, further complemented by pledges from congregation members and friends. Additional financial support was provided through grants and incentives, including the MadiSUN Backyard Solar grant and Focus on Energy support. Enthusiasm surrounding the project sparked additional donations from congregation members.

Beyond achieving self-sufficiency through energy generation, St. Dunstan’s remains firmly committed to community service and outreach. The solar project aligns harmoniously with their mission of social justice and community support. As energy costs rise and budgetary pressures mount, the solar project is anticipated to alleviate some of these financial burdens, enabling the church to reallocate funds back into its mission.

In the summer of 2023, St. Dunstan’s hosted a solar dedication event. This event served as an opportunity to celebrate and promote their 29.7-kilowatt solar array to their congregation and the wider community. It included information sessions on the economic and environmental benefits of solar energy, as well as details regarding financial incentives for installing a solar system.

St. Dunstan’s Episcopal Church’s commitment to renewable energy is a shining example of how faith-based organizations can lead by example in environmental stewardship while simultaneously nurturing a sense of community, social justice, and environmental consciousness. Their dedication to their values and the environment serves as a compelling illustration of the positive impact such initiatives can have on local communities and the broader world.

by Lauren Cohen | Sep 28, 2023 | Renewables, Solar, Solar for Good

On Sunday, September 24, People’s United Methodist Church (PUMC) hosted a dedication ceremony to celebrate the completion of its solar array. The solar project is substantial, with an installed capacity of 70.3 kW, poised to offset approximately 64 percent of the church’s power consumption. In addition, a 7.56-kW installation at the church house is expected to generate 10,000 kWh annually, covering 94 percent of its current power usage.

PUMC’s commitment to sustainability extends beyond solar installations. They were named a 2023 Climate Champion by the Dane County Office of Energy and Climate Change for their consistent efforts.

“Climate justice is social justice, and our commitment will do more for people worldwide than almost any other effort we can support at this time,” said representatives from the church. “Together, we are doing a powerful ministry for our world today and for future generations.”

Funding for this solar project was secured from various sources, including a grant from Solar for Good, financial support from Focus on Energy, and a 30% elective pay from the federal government under the Inflation Reduction Act. A vital component of their fundraising efforts was a capital campaign, fortified by a pledge from an internal donor.

Established in 1845, PUMC has been a steadfast presence in their community. PUMC is a Christian community of faith open to all people, focused on issues such as racial inequality, food security, and environmental justice.

PUMC’s journey in environmental stewardship began with small-scale initiatives; however, their ambitions for sustainability expanded in 2019 when they initiated plans for a solar installation. Unfortunately, the COVID-19 pandemic introduced logistical challenges and financial uncertainties that momentarily halted progress.

Nevertheless, their objective remained unchanged — commit to environmental stewardship and reduce their carbon footprint. They also sought to enhance community engagement by participating in the Midwest Solar group buy program for Dane County in the spring of 2023 as part of their solar project.

“Midwest Solar Power was happy to work with the Peoples United Methodist Church and Solar For Good to bring solar to the church and parsonage,” said Alarik Roselund, Partner and Co-founder of Midwest Solar Power. Established in 2009, Midwest Solar Power is a Madison-based solar installation company dedicated to providing specialized and high-quality work to its clients.

Other notable works include participating in a Solar group buy, implementing recycling initiatives, hosting an annual Green Fair, and exploring the possibility of adding heat pumps for the church office and preschool.

PUMC’s solar project goes beyond a technological upgrade; it exemplifies its commitment to environmental preservation and carbon footprint reduction. This effort guarantees not only long-term reductions in utility costs but also allocates substantial financial resources that can be redirected toward their other critical social justice initiatives. PUMC’s journey toward environmental stewardship stands as a compelling example for other nonprofit organizations and community groups, showing how sustainable practices can foster positive change.

by Lauren Cohen | Sep 28, 2023 | Renewables, Solar for Good

On Thursday, September 28, the Northwest Side Community Development Corporation (NWSCDC) celebrated the completion of their 8.88-kilowatt solar system at their Green Tech Station Facility. The solar installation on this site represents a pivotal step forward for the former brownfield site.

Green Tech Station’s significance lies not only in its solar capabilities but also in its role as an outdoor environmental education destination. This site has been thoughtfully designed to attract hundreds of visitors each year, catering to individuals of all ages.

NWSCDC, a nonprofit community development organization established in 1983, operates across multiple program areas with the goal of supporting neighborhood stability and economic growth.

“The solar electric generation at Green Tech Station will offset our energy use at the site and allows us to expand the environmental education and green technology features for learning and observation,” said Andrew Haug, Senior Development Manager at NWSCDC. “Students, community groups, and researchers will benefit by seeing renewable energy working together with stormwater management.”

The journey from a remediated brownfield to an outdoor education hub is remarkable. The site boasts a host of features, including bioswales, an underground stormwater cistern, over 465 newly planted trees, the restoration of native prairie, and the creation of a constructed wetland. These elements collectively provide a tangible opportunity for visitors to witness sustainable practices and green technologies in action.

An outdoor pavilion, completed in late 2021, serves as the educational focal point of Green Tech Station. As NWSCDC highlights its solar array, visitors can expect both an educational experience and a practical demonstration of renewable energy.

The system, installed by Full Spectrum Solar, is projected to offset more than 100% of their electrical use, with the excess energy being channeled back into the grid, creating savings that will be reinvested into programming and maintenance at Green Tech Station.

NWSCDC’s solar array signifies a significant step toward sustainability and stands as a symbol of progress and education within the Milwaukee community. This solar installation’s capacity to generate clean energy showcases the potential of renewable technology.

The installation powers the facility and serves as a lesson on the benefits of embracing renewable energy solutions. As hundreds of visitors, young and old, explore Green Tech Station, they are offered a tangible opportunity to witness firsthand how renewable energy and environmental stewardship can coexist.

by Michael Vickerman | Sep 13, 2023 | PSC Priorities, Public Service Commission, RENEW Wisconsin, Renewables, Solar, Utilities

A 200-megawatt (MW) solar project, Silver Maple Solar, has been proposed in Fond du Lac and Winnebago Counties. If approved, Silver Maple Solar is expected to begin producing enough clean energy to power 35,000 Wisconsin homes by the end of 2025.

Solar power projects larger than 100 MW must gain approval from the Public Service Commission of Wisconsin (PSCW) before they can proceed to construction. Along the way, there are opportunities for public comment, including at the PSCW. Earlier this summer, RENEW Wisconsin submitted testimony in support of Silver Maple Solar to the PSCW. Now that the public comment period is open, you can share your support for this project as well.

Silver Maple Solar represents a significant economic investment in rural southeastern Wisconsin, providing steady revenues to area landowners and communities while generating emission-free renewable electricity for more than 30 years. The developer of the project, Leeward Renewable Energy, has provided a high-level overview and a map of the project to help the public better understand its benefits.

Since 2019, the PSCW has issued approvals for 17 solar power projects across Wisconsin, totaling 3,249 MW. With the addition of Silver Maple, solar energy will make up 10% of Wisconsin’s electricity production, the highest share for a state in the Upper Midwest.

Help us demonstrate Wisconsin’s enthusiastic support for projects like this by submitting a comment in support of Silver Maple Solar. Be sure to specifically reference the project and the benefits that it can bring to Wisconsin. The deadline to submit comments is October 13, 2023.

We’ve included a sample message to help you get started. Please keep in mind that the PSCW allows one comment per case and that customizing your message will have a greater impact.

Sample Comment

I’m writing in support of the Silver Maple Solar, under review in Docket No. 9813-CE-100. This project would support local economies and keep energy dollars in state by producing homegrown, renewable energy right here in Wisconsin.

Beyond the economic benefits, the Silver Maple Solar project will also help to displace carbon dioxide, support grid stability, and provide Wisconsinites with an affordable source of electricity. With available land and appropriate infrastructure, projects like this make sense for Wisconsin.

I respectfully encourage the PSCW to rule that Silver Maple Solar is in the public interest and issue a permit enabling the project to proceed to construction. Thank you for your consideration of my views.

by Nolan Stumpf | Jun 27, 2023 | Electric Vehicles, Renewables, Solar

Solar fields can supply abundant, clean electricity – almost one-third of Wisconsin’s consumption by 2050 – using only a small portion of the state’s agricultural land. Nonetheless, solar energy development in agricultural areas raises new discussions of land use in Wisconsin. A recent report explores Wisconsin’s agricultural trends and outlines the potential solar energy has to sustain the state’s agricultural heritage, keep Wisconsin farmers in business, and provide environmental and economic benefits to the greater public. This blog will summarize the report’s findings and discuss the implications of solar energy development on land use for farmers in Wisconsin.

Wisconsin’s changing agricultural landscape

Wisconsin’s agricultural economy has changed substantially over the last several decades due to technological advancements, improved farm practices, evolving market conditions, and other macroeconomic trends. Data from the USDA National Agricultural Statistics Service shows that the amount of actively cultivated farmland has decreased by 23% since 1982, alongside the number of farm operations (from 90,000 to 64,100 in 2022).

At the same time, due to advancements in practices and technology, corn and soybean yields have increased dramatically (69% for corn and 75% for soybeans). However, the market’s oversupply has caused inflation-adjusted prices for corn to gradually decrease since 1909. Real prices for corn in 2022 are 51% lower than in 1940 and 42% lower than in 1980. Commodity price volatility has also added financial uncertainty for farmers, with farmers experiencing large annual swings in the prices received for corn. The downward trend in real prices and constant volatility in nominal prices shows why corn producers and other Wisconsin farmers face growing pressure to scale up their operations or sell their land.

Enrollment in the USDA’s Conservation Reserve Program (CRP), an ecosystem services program aimed at improving soil health and managing the oversupply of crops, has been decreasing since the early 2000s in Wisconsin. However, about 200,000 acres of voluntarily retired farmland under the CRP in the state is planted with ground covers such as grasses, trees, and native plants in exchange for an annual payment from the federal government.

Achieving a net-zero economy in Wisconsin with solar energy

Recent trends have allowed farmers to incorporate solar developments into a portion of their property and, at the same time, continue farming and sustaining their agricultural businesses. Solar fields offer stable revenue streams for Wisconsin farmers and financial support to local governments through the state’s shared revenue formula. RENEW Wisconsin’s collaborative report, Achieving 100% Clean Energy in Wisconsin (100% Clean Energy Report), shows that solar development opportunities will grow for Wisconsin farmers over the next few decades. According to the report, solar energy will be Wisconsin’s predominant source of new emission-free electricity generation to achieve a net-zero economy. In the most economical net-zero scenario explored in the 100% Clean Energy Report, 28.3 Gigawatts (GW) of utility-scale solar would be installed by 2050.

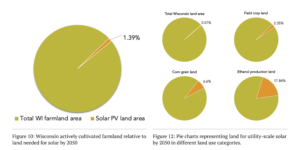

Solar energy will cover a relatively small amount of land by 2050

Based on the 100% Clean Energy Report, assuming the land footprint for 1 MW of utility-scale solar is 7 acres, approximately 198,000 acres would be required to host utility-scale solar in Wisconsin by 2050. Our analysis assumed 7 acres per MW of utility-scale solar PV to account for the increased productivity of solar panels over time. As one of the leading renewable resource technologies for the clean energy transition, solar panel design and installation layout will likely improve in the coming years, meaning solar fields will generate more electricity with fewer total inputs – including land.

Building 28.3 GW of utility-scale solar capacity would require 198,000 acres of land, which is 0.57% of Wisconsin’s total land area (34.7 million acres). This would equate to 1.4% of total agricultural land (14.2 million acres) or about 2.4% of field cropland (8.4 million acres) in Wisconsin from another perspective. These percentages assume all of the 28.3 GW of solar would be sited on agricultural land, which is unlikely. Though utility-scale solar developments have predominately been sited on farmland in the past, a study from UW-Stevens Point shows the vast land area across the state that may be suitable for utility-scale solar development.

Ethanol and the future of energy farming

Farming for energy production is already common in Wisconsin, with about 37% of the corn grown used for ethanol. Wisconsin would only need to convert about 18% of corn-ethanol land to solar energy production by 2050 to achieve 28.3 GW of capacity. With a likely decrease in demand for corn-based ethanol needed by 2050 (due to the adoption of electric vehicles and substitution toward non-food crop feedstocks for biofuels), incorporating solar generation on farms is a way for Wisconsin farmers to help sustain their businesses.

A study by CLEAN Wisconsin demonstrates the efficiency of electric vehicles powered by solar energy over ethanol-powered vehicles. Their report finds that ethanol used in internal combustion engines requires about 85 times the amount of land to power the same amount of driving as solar-charged electric vehicles. Increased adoption of electric vehicles leads to decreasing gasoline demand and correspondingly diminishing the need for ethanol. With all else held constant, this trend will inexorably dampen corn prices received by the growers supplying local ethanol plants. Incorporating solar generation on farms is a way to sustain agriculture in Wisconsin, providing farmers with a stable revenue stream for years.

Co-benefits of solar energy on farms

Solar projects can provide beneficial ecosystem services to farmers and landowners in Wisconsin. Solar farms can last up to 35 years, allowing the land and soil underneath the arrays to rest and recover. Once a solar installation is decommissioned, the land can once again be farmed and will be more fertile when replanted, in contrast to residential or commercial development, which is much more permanent when complete [11]. Planting native plants and grasses amongst the arrays is becoming a standard practice, improving soil health and serving as pollinator environments.

In addition, advancements in design and technology have spurred research into agrivoltaics, or the simultaneous land use of solar energy generation and conventional agricultural activities. This co-location of activities provides many additional benefits, including dual revenue streams for the landowner and reduced heat stress on crops or grazing animals due to the shade of the solar panels. By altering the panels’ standard configurations and tilt schedules, researchers are investigating how to optimize crop yields and energy production.

Solar energy can help sustain Wisconsin farm businesses

Solar fields can supply almost one-third of Wisconsin’s electricity consumption in 2050 using a small portion of agricultural land. Nonetheless, agriculture is a significant part of Wisconsin’s economic and cultural identity, and Wisconsinites are connected to the image of Wisconsin’s landscape. As the farming industry continues to change, Wisconsin must allow farmers’ businesses to evolve. Solar developments can help family farms thrive with stable lease payments, support diverse soil health and ecosystem service benefits, and create local economic benefits. Wisconsin farmers and solar energy are helping to advance a stronger, healthier Wisconsin powered by clean energy.