by jboullion | Aug 28, 2014 | Uncategorized

Experts find no evidence to support proposal

Press Release from RENEW Wisconsin and Environmental Law & Policy Center

August 28, 2014

MADISON, WI – Expert witnesses criticized We Energies’ proposals to raise “fixed” charges for everyone and add fees and restrictions to customers that wish to generate clean, renewable energy on their own property, in testimony filed Thursday with the Public Service Commission of Wisconsin.

Experts for RENEW Wisconsin and the Environmental Law & Policy Center determined that We Energies’ proposed billing changes are unjustified, would reduce all customers’ ability to control their electricity bills, and would stifle the growth of energy efficiency and renewable energy.

Karl Rábago of Rábago Energy, LLC called the proposal “an astounding failure of basic ratemaking” and determined that the Company provided “no reasonable justification” for imposing charges on their customers.

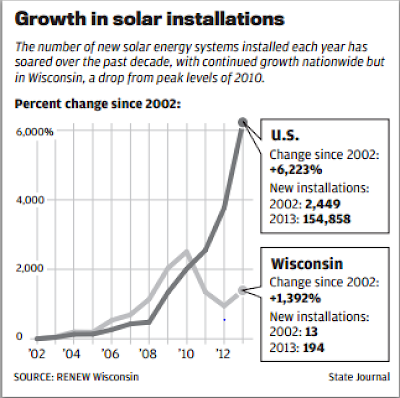

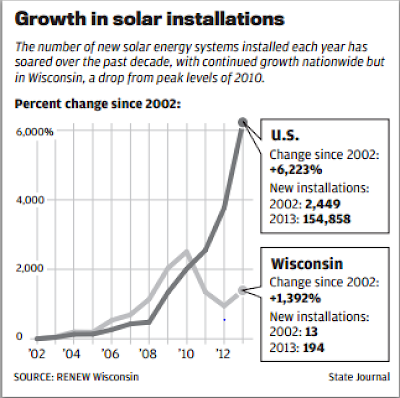

Michael Vickerman of RENEW Wisconsin concluded the proposal would cripple the solar industry in Wisconsin, and would reduce a customer’s return from a new solar system by more than one-third (35%) and slash savings from an existing system by nearly one-half (47%).

Brad Klein, senior attorney at the Environmental Law & Policy Center, called the proposal a dangerous precedent. “We Energies is attempting to exert its monopoly power to restrict customer choice and take money out of the pockets of customers who use less energy.”

Tyler Huebner, executive director of RENEW Wisconsin said, “We Energies’ proposals, if approved, would punish customers who have done the right thing by going solar, and take away jobs for the small businesses that make a living in this industry which has grown nationally to over 140,000 employees through 2013.”

The new charges and service restrictions contemplated by We Energies include:

§ Increasing monthly fixed charges by more than 75%, which would disproportionately affect customers that use less energy (see “Robin Hood in Reverse” release)

§ Adding a new “capacity demand” charge that alone will offset nearly 30% of a customer’s savings from solar

§ Paying solar generators just 4.2 cents for each extra kilowatt-hour of electricity they create, while re-selling that electricity to other customers at up to 28 cents during peak daytime summer hours

§ Restricting solar energy financing options that help low-income customers, municipalities, churches and non-profits more affordably go solar

The expert witnesses’ main recommendations were to reject the utility’s proposals. “A broader discussion is needed to enable us to ‘look before we leap’ – to carefully examine both the benefits and costs of customers producing their own clean power before simply accepting this utility’s view,” said Huebner.

More information:

· RENEW Wisconsin’s testimony in this We Energies case can be found at the Public Service Commission’s website, http://psc.wi.gov/apps35/ERF_search/default.aspx, by searching for Docket 5-UR-107.

· Testimony in this case comes on the heels of testimony filed two weeks ago in the Wisconsin Public Service rate case, Docket 6690-UR-123, which RENEW Wisconsin characterized as “Robin Hood in Reverse.”

· RENEW also recently discussed We Energies’ proposed changes which would affect future biogas projects. See press release.

RENEW Wisconsin is an independent, nonprofit 501(c)(3) organization that leads and accelerates the transformation to Wisconsin’s renewable energy future through advocacy, education, and collaboration.

ELPC is the Midwest’s leading public interest environmental legal advocacy and eco-business innovation organization. We develop and lead successful strategic advocacy campaigns to improve environmental quality and protect our natural resources.

by jboullion | Aug 28, 2014 | Uncategorized

RENEW’s Michael Vickerman is featured extensively in this article.

‘Unprecedented’ attempt to destroy solar industry and penalize clean energy users in Wisconsin

By Lisa Kaiser

August 27, 2014

At the very moment solar energy is becoming an affordable, realistic option for homeowners and businesses, the state’s largest utility, We Energies, is attempting to strike a fatal blow to this emerging industry.

At the very moment solar energy is becoming an affordable, realistic option for homeowners and businesses, the state’s largest utility, We Energies, is attempting to strike a fatal blow to this emerging industry.

In its latest rate request in front of the state Public Service Commission (PSC), We Energies is seeking to charge its customers more and also add new penalties to those who use renewable energy, making solar panels and other green systems less affordable for the average property owner.

Renewable systems owners represent just a fraction of 1% of We Energies’ 2.2 million customers in eastern Wisconsin and Upper Michigan.

But, plagued by flat sales in a weak economy and bogged down by the high debt service costs for the expenditures We Energies made in its fossil fuel-based fleet and transmission lines, We Energies is turning to its most energy-efficient and independent customers for new sources of revenue.

Essentially, We Energies is asking its customers, who have tried to be more energy efficient, to pay higher fees to cover the costs for the backward-looking decisions We Energies made when it invested billions of dollars in what many people viewed as “dinosaur technology” 10 years ago. The We Energies executives got nice bonuses and we, the ratepayers, got stuck paying for these bonuses.

Instead of promoting clean energy and energy efficiency or competing on a fair playing field, We Energies wants to punish it.

In effect, if you use little energy—whether you’ve got solar panels on your house or not—you’re going to pay more for your electricity in January 2015 if We Energies gets its way.

“They don’t like customers using less of their energy, it’s as simple as that,” said Michael Vickerman, RENEW Wisconsin’s program and policy director. “They want customers to be completely dependent on utility-supplied energy.”

The Request

We Energies’ proposed rate change is focused on its fixed charges—the ones covering We Energies’ investment in the grid, what’s called a “facilities charge” on your bill—and the more variable energy rate. We Energies seeks to increase that base facilities charge from $9 month to $16 a month for an average homeowner. Customers with renewable energy systems would see additional charges.

If granted, residential customers would see a 5% increase in their electricity rates next year, the Journal Sentinel reported.

We Energies spokesman Brian Manthey said the strategy aims to be transparent by showing customers how their payments are being used.

The monopoly is trying to sell its changes by insisting they’re “fair” by requiring all customers to pay into the grid, even those who only use it sporadically, such as solar owners.

“The cost should not be shifted to others for the use of the grid,” Manthey said.

But the net effect of We Energies’ proposal would be to increase the monthly bills of customers who use little energy, either through conservation measures such as installing energy-efficient appliances or through the use of renewable energy sources, such as solar panels. These customers will find little financial benefit from saving energy because that will be a smaller portion of their bill. On the other hand, heavy users of fossil fuel-generated electricity may see their bills decrease.

Vickerman said We Energies’ plan is to make it appear as if they’re lowering the energy rate even though they are really increasing small customers’ total monthly bills.

“They’re disguising a bill increase,” Vickerman said.

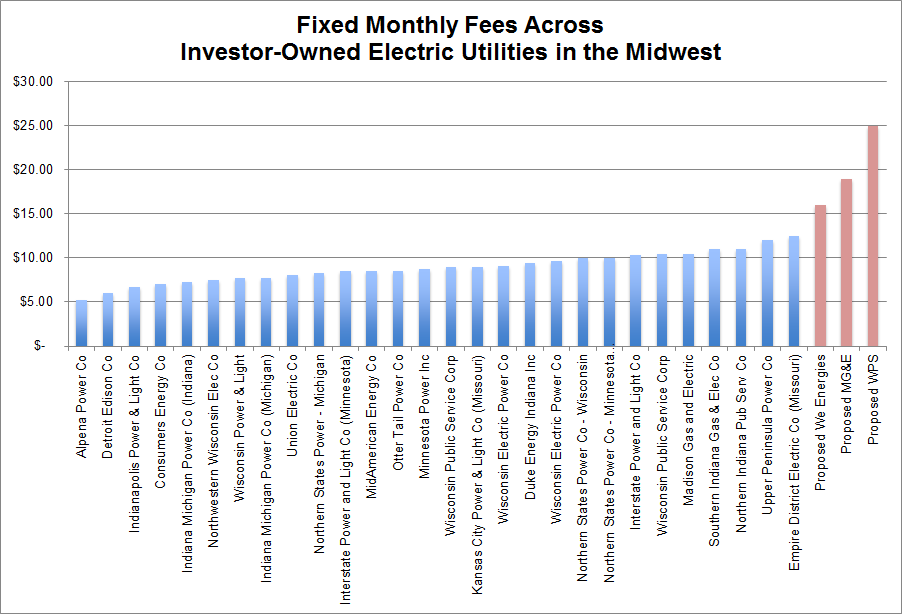

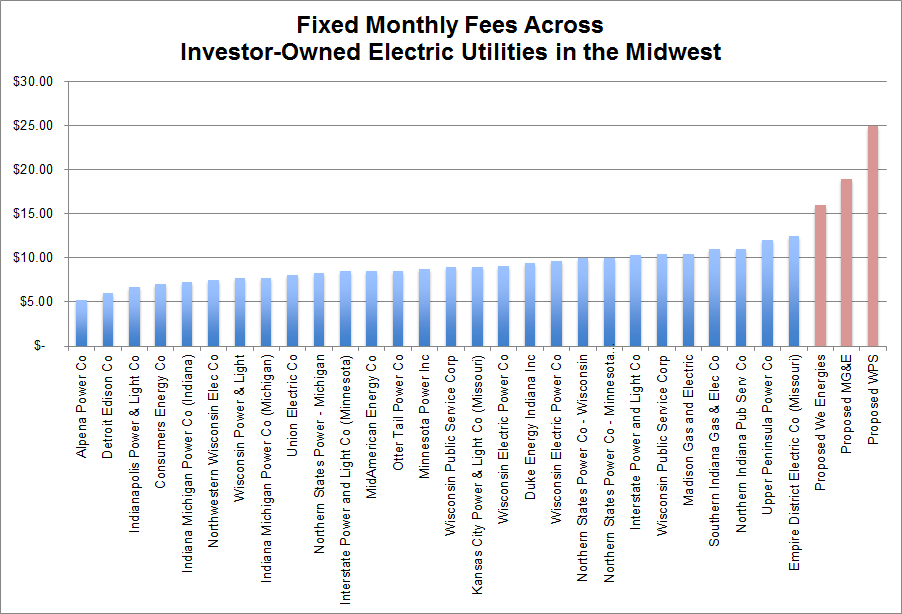

And, making matters worse, two other Wisconsin utilities—Madison Gas & Electric (MG&E) in Madison and the Wisconsin Public Service Corp. (WPS) in Green Bay—are attempting to change their rate structures as well in their current cases before the PSC. If granted, the three utilities’ base rates will be the highest in the Midwest, according to an analysis by the Environmental Law & Policy Center. MG&E has already backed away from its original proposal.

“It’s a rather unprecedented situation we’re facing in Wisconsin where three of the largest utilities are proposing massive increases to their monthly fixed charges,” Vickerman said. “We are not seeing such extreme proposals in other parts of the Midwest and around the country.”

In addition to this change in billing, We Energies also seeks to impose new fees on customers who generate their own electricity, whether through solar, wind or biogas. Solar owners would see an estimated 30% increase in their bills, Vickerman said.

These new penalties include:

Adding a new charge for all clean energy system owners simply for investing in their own system. Entities with solar investments would also be subject to a new $3.80 per kilowatt per month fee. The average homeowner with a small solar system would pay We Energies an estimated $192 annually.

But it would also affect nonprofits like Habitat for Humanity, which installed solar on dozens of their homes; places of worship such as St. Marcus Lutheran in Milwaukee and Elm Grove Lutheran; businesses such as Johnson Controls, GE Health Care and Kohl’s; schools and universities including MATC, UW-Milwaukee and the Milwaukee School of Engineering; and local governments such as Milwaukee, Racine, Wauwatosa and Brookfield.

A much higher fee would be placed on owners of biodigesters, such as the Potawatomi Bingo and Casino and the Metropolitan Milwaukee Sewerage District (MMSD).

Steve Jacquart, intergovernmental coordinator for MMSD, said the district has invested in renewables to reduce the cost of cleaning water, which is energy intensive, and increase its energy independence and use of renewables. But We Energies’ proposal would drastically increase MMSD’s electricity costs, which no doubt will be passed along to everyone in its district.

“We’re very concerned because the proposed We Energies tariffs will hurt our ratepayers by significantly increasing the cost of electricity for MMSD,” Jacquart said. “Although the proposed rate changes will hit residents, the impact will be greatest on businesses that use large amounts of water. We need to be careful that We Energies’ proposal doesn’t undermine our region’s economy and job growth.”

Reducing the buyback price for solar. Solar owners benefit the utility by selling back their excess energy, typically during peak hours, such as on hot, sunny days. This also helps solar owners recoup their investment in their system. We Energies wants to change this from an annual to a monthly meter check and pay solar owners far less for their clean energy. This means that it will take longer for a solar owner to pay off their system. We Energies, of course, can charge its other customers premium rates for this renewable-sourced peak energy, further increasing its revenues.

Restricting third-party ownership or leasing of solar systems. Although it’s allowed in other states, We Energies is trying to ban, outright, any third-party involvement in solar energy. Third-party ownership is illegal in Wisconsin, but third-party leases, in which a solar operator sets up a system and rents it out to a customer, isn’t explicitly prohibited.

Matt Neumann, owner of SunVest Solar in Waukesha, said his company has a thriving business in other states that allow third-party leases. But We Energies is trying to ban this type of operation in the state through its rate case pending before the PSC. Neumann said that policy discussion is better left to the Legislature—not We Energies.

“They’re not stupid,” Neumann said of We Energies. “About 80% of the installs are happening across the country are happening with third-party financing.”

The Threat of Competition

Neumann said We Energies’ proposal would have a long-term negative impact on Wisconsin’s solar industry by weakening companies such as his and making solar an unaffordable investment for property owners. Faced with competition for the first time, We Energies, a regulated monopoly, is trying to crush it instead of using it to upgrade its business model.

Amy Heart, sustainability program manager for the city of Milwaukee, said We Energies’ proposal runs counter to the city’s attempt to become more energy efficient and independent, as well as the state’s energy policy, a statute that prioritizes renewables and efficiency over fossil fuels.

“That’s the crux of the matter before the PSC,” Heart said.

The PSC is a three-member panel made up of appointees of the governor. Two of the current members were appointed by Gov. Scott Walker—former Republican state Rep. Phil Montgomery, a former American Legislative Exchange Council (ALEC) Legislator of the Year for his work deregulating the telecom industry, and Ellen Nowak, the former chief of staff to Waukesha County Executive Dan Vrakas. The third member, Eric Callisto, was appointed by then-Gov. Jim Doyle.

The city of Milwaukee, RENEW Wisconsin, MMSD and SolarVest among others have decided to intervene in the case. Members of the public are encouraged to file their comments with the PSC before Sept. 24 (Docket No. 5-UR-107) and attend a hearing on Oct. 8 in Milwaukee as well.

Next week, Alderman Tony Zielinski will introduce a resolution opposing We Energies’ proposal, saying that it would increase residential customers’ electricity bills by 5%.

“The proposed rate increase plan punishes those who use solar and other renewable energy systems that We Energies likely believes will threaten to take a few dollars out of the energy giant’s massive and bloated coffers,” Zielinski said in a press release.

RENEW’s Vickerman, for his part, is going to fight it tooth and nail.

“This is such a clear-cut assault on solar generation that we just have to ask to take this damn proposal off the table,” Vickerman said. “It is so punitive. These would be very substantial changes and there would be no transition period. It’s going to shock a lot of people when they see that first bill. This is really an existential threat to the solar industry in We Energies’ territory. We have to fight it off. We have no choice.”

RENEW is asking those concerned about the three Wisconsin utilities’ attack on solar power to make their voices heard. It’s published an action sheet at renewwisconsin.org/current.htm. The city of Milwaukee offers a fact sheet as well on its website at city.milwaukee.gov/sustainability.

Milwaukee Shines On

We Energies’ proposal would have a huge impact on Milwaukee, which was one of the first cities to earn the federal government’s designation as a “solar city.” In combination with its far-reaching sustainability plan, ReFresh Milwaukee, the city has encouraged energy efficiency and the installation of solar panel systems on homes and businesses. It developed two neighborhood group buys in Riverwest and Bay View, through which 65 homeowners—including this reporter—found an affordable and convenient way to go solar in the heart of the city. Mayor Tom Barrett just announced the expansion of the program to the Layton Boulevard West and Washington Heights neighborhoods just last week.

Amy Heart said the success of the Milwaukee Shines program indicates that momentum is moving in the direction of solar. The city would move forward with its program despite We Energies’ proposal, Heart said.

“Milwaukee residents and businesses who see their electricity bills go up every year are naturally looking for alternatives to control their long-term energy costs,” Heart said. “Unfortunately, We Energies is proposing new charges and restrictions that will make it more difficult for not only homeowners to access solutions for their own homes but make it more difficult for the city to reach its own goals.”

Steve Barnicki in Bay View just got his solar panels installed via the neighborhood program. An electrical and biomedical engineer, Barnicki said he thought it was wasteful to allow his attic to heat up to 120 degrees without harnessing it.

He said he was totally opposed to We Energies’ plans to tax him because he invested in his own solar panels.

“I don’t understand why I need to pay a tax to a monopoly for helping them with their green energy, which they charge people more for if you want to opt into that,” Barnicki said. “Why should they tax me for helping them out?”

What’s Fair?

We Energies claims it’s changing the way it charges solar system owners because it’s “fair.” It’s launched a PR campaign to explain that it’s going to charge solar owners more for their use of the grid so that it doesn’t have to shift costs to customers who rely on the utility’s traditional fossil fuel-generated electricity and infrastructure.

“These customers use the grid just as much and often more than customers who do not generate their own power,” We Energies explains in a fact sheet about “renewable energy fairness.”

Matt Neumann, owner of the solar installer SunVest, disagrees with We Energies’ concept of fairness. He said solar owners help the utility because they produce excess energy when the utility needs it the most—typically on hot, sunny days—and when it’s the most expensive time for We Energies to produce it. In addition, solar owners only use the grid when they are selling or receiving electricity from We Energies, not when they are using their solar-produced electricity on their properties. Therefore, it’s unfair to ask solar owners to pay huge sums for the use of We Energies’ grid, he said.

“We shouldn’t have to pay the same amount for transmission expenses for all of our energy,” Neumann said.

Michael Vickerman of RENEW Wisconsin said We Energies is being unfair by deciding to penalize customers it had encouraged to go solar. Since nonprofits weren’t able to utilize a federal tax credit for renewables, We Energies had developed a discount for churches, schools and other nonprofits that wanted to install solar.

“Most of those installations went up in 2010, 2011,” Vickerman said. “And here comes We Energies five years later trying to take back those incentive dollars by imposing a charge that amounts to 30% of the gross output of the system,” Vickerman said. “It’s a complete about face. Those incentives came out from the same rate base that We Energies is now claiming is being threatened by the spread of solar energy. So how did the definition of fairness change so radically?”

by jboullion | Aug 21, 2014 | Uncategorized

from Midwest Energy News

Posted on 08/20/2014 by Kari Lydersen

A closely watched battle over utility policy in Wisconsin could determine the fate of solar development throughout the region, advocates say.

The dispute is over three major rate cases recently filed by We Energies, Madison Gas & Electric and Wisconsin Public Service Corporation. The three utilities cover much of the eastern half of the state as well as its largest cities.

If the state Public Service Commission (PSC) approves the cases, solar experts say there will be a massive chill over solar development in these utilities’ service territories. And they expect other utilities in Wisconsin and beyond will file similar requests.

All three cases would significantly restructure the way residential and business customers are charged for electricity, so that all customers pay a higher fixed amount each month while the variable charges based on electricity use are reduced.

This creates an inherent disincentive to reduce energy use – whether through installing solar panels or increasing energy efficiency. RENEW Wisconsin program and policy director Michael Vickerman described it as a “reverse Robin Hood” move that shifts the burden of paying for electricity from large energy consumers to small consumers.

The We Energies case, which advocates find the most objectionable, also changes the terms of net metering so it would be far less beneficial financially to send energy back to the grid.

We Energies also wants to impose an additional monthly charge on distributed energy installations, and would prohibit solar installations owned by a third party from interconnecting to the grid. Since a majority of residents installing solar nationwide now use such third party financing and ownership arrangements to make solar affordable, this could be a death knell for residential solar in Wisconsin.

Some solar advocates fear the ripple effects could also be felt in other states. We Energies’ parent company is in the midst of acquiring Integrys in a $9.1 billion merger. That means its solar plans could have direct and indirect influence on utilities around the country.

“These proposals are designed to do one thing – eliminate solar and stop competition,” said Bryan Miller, executive director of The Alliance for Solar Choice (TASC), a coalition of rooftop solar companies. “These are being pushed in a state that has very little solar. It is the ultimate swatting a fly with a nuclear weapon.”

The Federal Energy Regulatory Commission and state regulators in Illinois, Michigan, Minnesota and Wisconsin will need to approve the merger. Solar advocates hope regulators will take the rate case into consideration as they make their decisions.

Shifting costs

Spokespeople for We Energies and WPS said the restructuring is an overdue and necessary way to more accurately reflect the costs of delivering electricity. They say that customers who generate energy onsite are essentially getting the benefit of the grid when they need it but aren’t paying their fair share to keep that infrastructure in place.

“We want to make sure the costs for maintaining our electric system are shared in a fair manner, that is more representative of where those costs lie,” said We Energies spokesman Brian Manthey.

“The actual fixed cost for meters, poles and wires are things that really don’t vary from customer to customer – they are just as much for a customer using a small amount of electricity as a customer who uses a lot of energy,” Manthey said. “But they’re being picked up by the other customers who can’t afford renewable energy systems or don’t want them.”

Nationwide, clean-energy advocates say that utilities fear a fundamental shift in the energy landscape wherein the rise of solar and distributed generation greatly reduces demand for their services and slashes into their profit margins and their ability to pay for infrastructure.

But in Wisconsin, the amount of distributed solar energy is still “infinitesimally small,” in Vickerman’s words, between 3 and 8 MW in each service territory. So, advocates say, concerns about the grid falling into disrepair ring hollow.

“That is pure poppycock,” said Vickerman. “All three utilities are financially healthy, they are bringing in revenue to cover expenses and earn returns for shareholders. It’s not as if they are losing money and ailing. They are doing just fine.”

“It’s early in Wisconsin but you can see where it’s going,” countered WPS spokesman Kerry Spees.

“The way we’re collecting those costs right now is not going to be viable for the long term as people use less, whether because of distributed generation or energy efficiency.”

In a regulated state like Wisconsin, where the same companies generate and distribute electricity, utilities can also try to recoup sunken costs from building power plants through their electricity charges. Vickerman thinks that’s part of the motivation for the rate changes.

The numbers

We Energies wants to create a new fixed monthly charge for distributed generation based on capacity: $3.79/kW for solar and wind generators and $8.60/kW for baseload generators, like biogas operations at dairy farms or even the Milwaukee Metropolitan Sewerage District, which generates electricity from landfill and sewage operations.

The new charge would apply to any new customers starting in 2016 and also to existing customers who don’t have a power purchase agreement to sell their electricity back to the utility. The new charge could reduce returns by nearly 30 percent, according to analysis by RENEW Wisconsin.

Meanwhile We Energies would also cut by more than half the amount paid for bioenergy derived from manure or food waste processed into methane in digesters, a growing movement in Wisconsin. The rate per kWh would go from 9.2 to 4.2 cents.

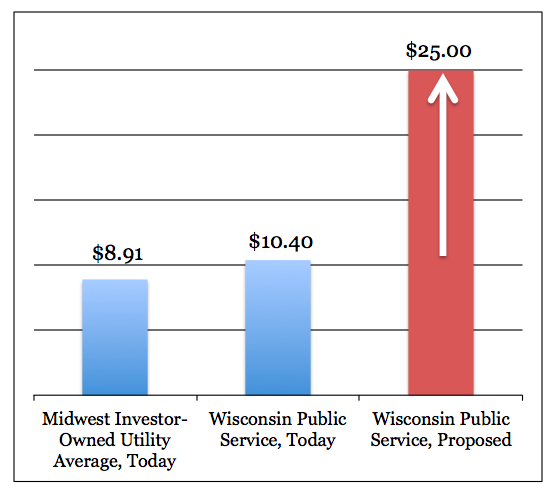

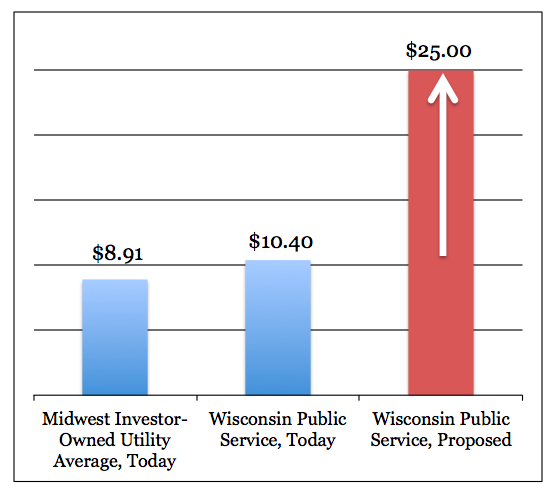

The WPS case would raise fixed costs from $10 a month to $25 for residential customers and $35 for business customers. Meanwhile it would lower the charge for amount of electricity used from 11.3 cents/kWh down to 10.1 cents/kWh.

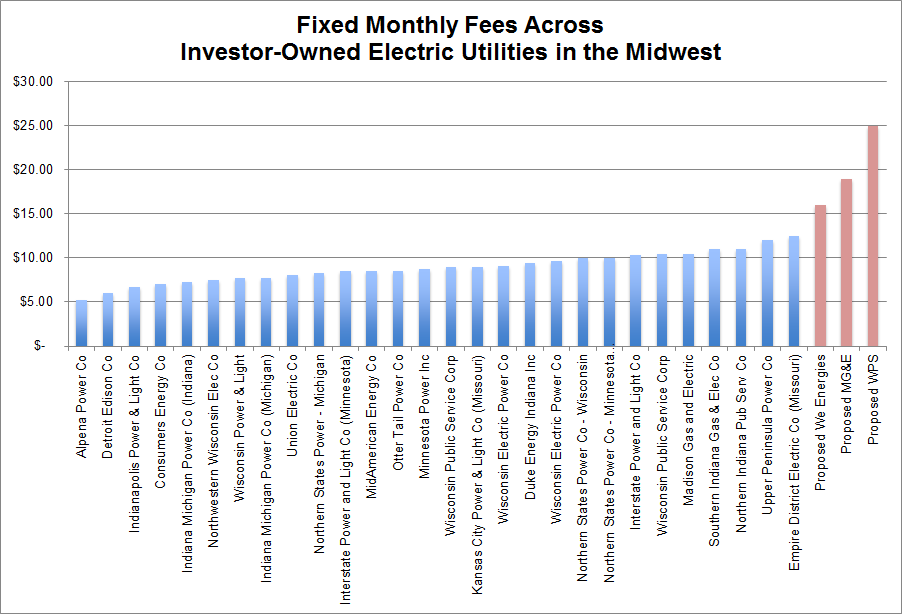

A chart prepared by RENEW Wisconsin shows that the three utilities’ planned fixed charges are significantly higher than other major utilities in the state, with WPS by far the highest.

Spees said that’s because WPS’s territory in northern Wisconsin is largely rural, meaning fewer people bearing the costs of the grid.

The proposed cost restructuring means that it will take solar customers much longer to recoup the cost of their installation through savings on energy bills. Meanwhile a rate change also creates uncertainty, according to Vickerman, wherein customers will expect that rates could keep changing and make it impossible to predict the economics of solar or get financing for an installation.

The change in net metering in We Energies case would mean a loss of about 28 percent, or $22.75 a month, for a 6kW installation, according to RENEW’s calculations. The rate case proposes changing how net metering is calculated, and also reducing the rates paid to customers for electricity they generate – treating it as cheaper wholesale rather than retail rate electricity.

Matt Neumann is owner of SunVest Solar, Wisconsin’s largest solar installer, founded in 2009. If the We Energies case is approved, he predicts solar installations plummeting and significant layoffs at his and other companies.

“It would be devastating – it would end the economic argument to install solar at all,” he said. “The number one item everyone wants to know is how long is the payback? [Under the proposed rates] there’s not going to be economic justification for doing it, which would basically kill the industry.”

Third party pain

Currently Wisconsin’s electricity interconnection rule does not take any stand on third-party ownership — where an entity other than the utility or the customer can own the solar array — though the PSC has issued non-binding letters indicating resistance toward third-party financing.

Efforts to allow third-party ownership, including a recent proposal that drew support from the state’s Libertarian Party, have stalled in the legislature.

In July, the Iowa State Supreme Court supported the concept of third party ownership in its decision on the Eagle Point Solar case. While that case doesn’t have any official bearing on the Wisconsin commission’s decision, advocates say it should be taken into consideration.

Manthey said We Energies is just clarifying what the company views as the state’s existing position on third-party leasing. “At this point it is the interpretation of state law that third-party generation is not something that can be done,” he said.

The City of Milwaukee is promoting solar energy as a key plank of its new sustainability program. Amy Heart is solar program manager for the city’s sustainability office, which runs the solar initiative Milwaukee Shines. She said that city efforts yielded 30 new installations in 2013 and that number has already been topped for 2014.

Because of uncertainty over the PSC’s stance on third-party ownership, she said the city has found other ways to fund solar installations. A city program with a credit union provides low-interest loans for the upfront costs, and the city also administers a bulk buy program allowing customers to get installations at a discount.

While We Energies’ prohibition on third-party ownership would not apply to these installations, Heart is very concerned about the implications if We Energies is allowed to basically enshrine a ban on third-party ownership. She said city officials are also worried about other provisions of We Energies’ rate case and feel it could torpedo key goals of the sustainability plan, including increased energy efficiency and solar and wind installations on city property.

“The third-party limitation has already limited who moves forward with solar in the state,” Heart said. “The fact that it’s a gray area has already limited many people, including the city of Milwaukee from getting solar. Our concern is that barrier will continue to be a problem if this case goes through.”

Public process

Environmental and clean energy groups including RENEW Wisconsin, the city of Milwaukee and the Milwaukee Metropolitan Sewerage District are intervenors in the rate cases. That means they have legal standing as parties in the case and they will participate in the legal proceedings, which include calling witnesses and cross-examination.

Each case will have technical hearings and public hearings before the service commission. The public hearings are scheduled on September 10 in Madison for WPS, October 1 in Madison for MGE and October 8 in Milwaukee for We Energies.

The cases can be viewed and public comments submitted on the Public Service Commission’s website. The docket number for WPS is 6690-UR-123, We Energies is 5-UR-107 and MGE is 3270-UR-120.

We Energies had filed a motion to prevent the Environmental Law & Policy Center (ELPC) and TASC from being intervenors in the case, arguing that they had no local standing. But under public pressure that request was withdrawn.

Crowds are expected at the rate case hearings, a change for the usually arcane affairs that draw little public interest. A Credo petition calling on the utilities to withdraw their proposals drew almost 3,000 signatures within a few days of posting.

Arthur Harrington specializes in renewable energy and teaches an energy law course at Marquette University. He is installing solar he purchased through Milwaukee’s bulk buy program. He is disturbed by We Energies’ proposals, and also by the polarization of the debate.

“I really understand and appreciate We Energies’ need for a reasonable contribution of fixed capital for solar,” he said. “But it shouldn’t be so high as to discourage investment by homeowners. And there’s the whole issue of transparency.

“I think the current rate case provides an interesting opportunity for We Energies to engage in some creative solutions that are good for the environment and the ratepayer and send some positive signals in a baseload system that is heavily invested in coal.”

RENEW Wisconsin and the ELPC are members of RE-AMP, which publishes Midwest Energy News.

by jboullion | Aug 18, 2014 | Uncategorized

August 15, 2014 12:30 pm • By Mike Ivey | The Capital Times

Wisconsin’s investor-owned utilities are outpacing the rest of the Midwest in looking to increase monthly service fees for customers.

A new analysis from Renew Wisconsin shows the proposed hikes here would leave renters, homeowners and small business owners paying significantly more than customers in neighboring states.

Electric utilities in Wisconsin are struggling with how to cover the “fixed” costs of operating and maintaining electric systems — the poles, wires and other infrastructure — amid the increase in solar power usage and energy conservation. They want to dramatically hike the monthly service fees for most customers while reducing charges for the amount of electricity consumed.

But critics contend the changes will discourage customers from using less electricity and are simply a way for utilities to book higher profits to benefit their shareholders.

“This is effectively a ‘Robin Hood in reverse’ pricing model,” said RENEW director Tyler Huebner in a statement. “It unfairly raise bills for customers who use relatively little electricity over a year including apartment dwellers, people on fixed incomes and seasonal businesses.”

Green-Bay based Wisconsin Public Service Corp. is the latest investor owned-utility in the state to seek a major hike its in monthly services fees.

The company is asking regulators to OK an increase its monthly fee from $10.40 to $25 for residential customers. For small commercial customers, the monthly fixed charge would go from $12.50 to $35.

Those increases would be offset by a reduction of 10 percent to 13 percent on the charges for the amount of electricity used.

Last year, the state’s largest electric utility WE Energies was granted a 20 percent increase in fixed charges by the Public Service Commission and is now proposing a 75 percent jump in its fixed charge to $16 a month.

MGE had initially talked about raising the monthly customer charge from about $10 a month to nearly $50 by 2016 and potentially $70 by 2017.

But an agreement reached with the Citizens Utility Board now proposes raising the fee to $19 in 2015 and holding off on future hikes pending future negotiations between CUB and MGE.

MGE’s rate changes are being opposed by a variety of consumer and clean energy groups. The city of Madison is also fighting the changes and has approved spending up to $60,000 to hire outside experts to make their case before the PSC.

Regulators are expected to make a ruling on the service fees changes later this year.

Wisconsin was once considered something of a leader in energy conservation and renewable energy development. But under Gov. Scott Walker the state has fallen behind in those efforts, studies have shown.

Read the original article here.

by jboullion | Aug 14, 2014 | Uncategorized

This article was published electronically August 14, 2014 in the Energy & Environment News Service and is re-printed here with permission from the reporter.

Evan Lehmann, E&E reporter

Four years ago, a Wisconsin Republican urged his party to overcome its fear of environmental action, saying that a conservative green movement could strengthen both the economy and GOP candidates. Then he got clobbered.

Now his son is taking a turn. Matt Neumann hopes to convince state officials that Wisconsin needs a big expansion of solar power. Among his audience are members of the Republican Party including friends of his father, former U.S. Rep. Mark Neumann, who was later defeated in back-to-back primaries, first for governor in 2010 and then for the Senate two years later.

The younger Neumann resembles his dad, a former math teacher, both in looks and in his conspicuous conservatism. They both promote the environment, and they hope to make money conserving it. They do have one big difference: “Politics drives me nuts,” Matt Neumann said.

Instead of running for public office, he’s making his energy pitch as president of the Wisconsin Solar Energy Industries Association and as the co-owner of a solar installation business that he runs with his father.

Matt Neumann, president of the Wisconsin Solar Energy Industries Association. Photo courtesy of the Wisconsin Solar Energy Industries Association

He enters public policy at a turbulent time. Wisconsin has seen its installation of solar systems drop since 2010, following eight years of modest growth. The state now has about 17 megawatts of installed solar power, enough to provide electricity to about 2,600 homes, according to Neumann’s group. That amounts to about 0.1 percent of the state’s renewable energy. In other words, it’s barely perceptible. [RENEW Wisconsin note: solar electricity accounts for less than 0.03% of Wisconsin’s electricity.]

The key reason behind Wisconsin’s sluggish growth is opposition by its utility sector, according to advocates of renewable energy. Utilities like We Energies, Wisconsin Public Service Corp. and Madison Gas and Electric Co. are pre-positioning themselves to avoid potential future losses from homegrown power, like solar arrays, by seeking fixed rates rather than charging customers for the amount of energy they use.

That can discourage conservation, clean energy advocates say, and it might dampen the economic impetus for installing solar on your rooftop: If a customer can’t lower his or her power bills by using solar electricity, then the investment doesn’t make sense, advocates say.

Neumann uses conservative touchstones to describe the state of things. For him, it’s a lack of “liberty” that prevents a property owner from choosing how to power his or her home or business. He said this absence of “energy choice” contradicts Republican tenets, which run strong in a state where the governor, Scott Walker, is favored by the tea party.

“We’re very conservative here in Wisconsin,” Neumann said. “The reality is free market capitalism, the choice to choose how you buy your energy, and how you finance that acquisition, the ability to lower your long-term energy costs — those are all very conservative principles and yet for some reason we’re struggling to adapt.”

Protecting customers, or profits?

Rate proposals currently being considered by the Wisconsin Public Service Commission would increase fixed monthly costs from $9 to $16 for customers of We Energies, the state’s biggest utility. Bigger jumps are being sought by Wisconsin Public Service Corp., which wants to double the fixed costs for residential customers to $25, and Madison Gas and Electric, which proposed a monthly fixed fee of $68 by 2017 before settling for $19 next year. That’s an 82 percent jump.

We Energies is also asking regulators to allow it to pay much less for electricity generated by homeowners, who can sell excess power derived from solar panels and other systems to utilities. The company is seeking to decrease the current price of 14 cents per kilowatt-hour to between 3 and 5 cents.

Cathy Schulze, a spokeswoman for We Energies, said the current price is above market rate, and the cost is passed on to other ratepayers. She also said the utility is moving to fixed prices to ensure that customers without solar aren’t required to shoulder more of the costs of maintaining the grid’s infrastructure — like poles, wires and utility employees.

“The costs are shifting to those people who don’t have their own generation right now,” Schulze said. “It may not be as big of a problem right now, but as that [solar] industry continues to grow, you’re going to see that disparity and that cost grow wider.”

Others see it differently. Tyler Huebner, executive director of RENEW Wisconsin, which advocates for cleaner power, said that the utilities are trying to cover recent investments in coal and gas plants with higher fixed fees. Customers shouldn’t be tied to the cost of those plants, he said, if they find cheaper, cleaner power alternatives.

If the buyback rate for excess solar power drops from 14 cents to 4 cents, it would price solar systems out of the marketplace, he said. “That’s the concern,” Huebner said.

Neumann said solar could thrive in Wisconsin if lawmakers would clarify that third-party ownership of solar systems is allowed. His company is an example. SunVest Solar Inc. installs its own photovoltaic systems on homes, businesses and churches, and then sells the power to the property owner at a fixed rate over 20 years.

The rate is usually equivalent to the cost of conventional electricity, or lower, Neumann said, and it can expand the use of solar power because property owners don’t have to buy the equipment, which can cost up to $15,000 installed for a home.

On climate change: ‘I don’t know’

He’s hopeful that Wisconsin lawmakers will pass legislation allowing third-party financing. But he said the “big thing” that Republicans will have to overcome is the utilities’ argument that solar could increase the cost of electricity on those customers who don’t have it.

“It’s just plain not true,” Neumann said, noting that solar power cuts cost on utilities and customers by generating power at peak demand periods.

But the utilities seem to have the ear of lawmakers. State Sen. Robert Cowles, a Republican and chairman of the Energy, Consumer Protection and Government Reform Committee, said the idea that solar could shift the cost burden to other people is “pretty compelling.”

“I can tell you, the utilities are vehemently against this,” Cowles said of third-party ownership. “I’m not sure how we would get them to ever accept that. We would have to overwhelm them somehow. I mean, I’m not taking a position on this right now.”

Neumann, like his dad, is a conspicuous member of the Republican Party. As he emphasizes renewable energy, his party avoids it. The state GOP’s platform, adopted this year, doesn’t prioritize cleaner energy, or even mention it. Instead, the document promotes eliminating the Department of Energy and encourages environmental stewardship based on technology rather than “unnecessary government regulation.”

Neumann’s father, favored by some tea party groups during the primary for governor in 2010, pushed his party to expand its reach with young voters and others “put out from the Republican Party,” by mixing environmentalism into the GOP’s economic messaging. Among the ideas that Mark Neumann introduced in 2010 was a job-friendly plan to reduce carbon emissions.

“When I talk about the environment, that’s an issue people have been afraid to talk about on our side of the aisle,” he said at the time, seated beside future Gov. Scott Walker, a conservative Republican.

Neumann lost badly in the primary several months later as Walker sailed away with a 20-point victory.

For his part, Matt Neumann may stray from his party’s bosom, but he doesn’t abandon it. He looks at environmentalism through a lens of commerce. Pursuing it can enhance economic activity and provide jobs, he seems to say, but it’s unclear if environmentalism is an exclusive priority for him without the fiscal hangers-on.

He also treads carefully when asked about climate change. He declined to say if it’s occurring, something that might perhaps give him credibility when talking to conservatives about renewable energy.

“I don’t know on climate change,” Matt Neumann said. “I have no idea. I would have to study it a lot more — and probably should, given the industry we’re in.”

“I’m being totally honest with you — I just plain don’t know.”

Want to read more stories like this?

Click here to start a free trial to E&E — the best way to track policy and markets.

by jboullion | Aug 13, 2014 | Uncategorized

New billing scheme would punish customer

investments in efficiency, solar energy

In testimony pre-filed

today with the Public Service Commission, a former utility regulator and

utility executive criticized Wisconsin Public Service Corporation’s proposed restructuring

of electric rates and service charges.

The expert witness, Karl Rábago, will testify on behalf of RENEW Wisconsin and

the Environmental Law & Policy Center in September. Mr. Rábago stated

“the Company proposals reduce the value of energy savings and create a new,

unavoidable charge that punishes most those customers who have made the

greatest investments in clean and renewable energy options.”

Targeting residential and

small commercial customers, WPS seeks to sharply increase their base service

charges and lower their variable energy rates. For residential customers, the fixed

monthly fee would rise from $10.40 to $25. For small commercial customers, the fixed

monthly fee would climb from $12.50 to $35.

The energy rate would decline between 10% and 13%.

“This is effectively a ‘Robin Hood

in Reverse’ pricing model,” said Tyler Huebner, executive director of RENEW

Wisconsin, citing a term used by energy consultant Bill Marcus of JBS Energy. “It

would unfairly raise bills for customers who use relatively little electricity

over a year, including apartment dwellers, people on fixed incomes, and

seasonal businesses.”

If approved, the fixed fee

hikes sought by WPS would be the highest allowed for a regulated electric

utility in the Midwest. “The increase is so steep as to be literally off the

charts,” said Huebner.

Monthly fixed fees for residential customers of Wisconsin Public Service Corporation, as of today and proposed for 2015, compared to similar Midwestern utilities.

|

“This new billing scheme

would exact a financial penalty on customers who invested their savings in

clean energy systems that yield benefits to all WPS customers. A lower energy

rate creates a longer payback period for solar. It would dramatically lower

interest in solar self-generation by residential and small commercial customers

in 2015 and beyond. It could very well slam the door on solar for WPS’s customers,”

concluded Huebner.

The restructuring proposal

surfaced this spring as part of the Green Bay utility’s request for an overall 8%

increase in electric revenues over the next two years. The rate proposal is

under review by the Public Service Commission. We Energies and Madison Gas & Electric

have proposed similar changes, which would put their fixed monthly fees at 80%

and 113% above the Midwest average of $8.91, while WPS’ proposal would put it

181% above that average (see below).

The testimony of Karl Rábago and RENEW Wisconsin can be found here by

searching for docket number 6690-UR-123.

Graphic courtesy of the Environmental Law & Policy

Center. Data for both graphics comes

from OpenEI.org, an open-source data-sharing platform supported by the National

Renewable Energy Laboratory, and the U.S. Energy Information Administration at eia.gov. The

dataset included monthly fixed charges besides the “customer charge,”

such as a monthly distribution charge that is labeled separately on the bill,

to report the total monthly fixed rate.

-END-

RENEW

Wisconsin is an independent, nonprofit 501(c)(3) organization that leads and

accelerates the transformation to Wisconsin’s renewable energy future through

advocacy, education, and collaboration.

by jboullion | Aug 7, 2014 | Uncategorized

August 06, 2014 7:30 am • By Jessica VanEgeren| The Cap Times

Photo courtesy of the Capital Times article. Methane from manure digesters on the Crave Brothers Farm produce enough electricity to power 550 average homes.

Supporters of a surge in the construction of manure digesters and the non-fossil fuel bioenergy they produce say a proposed buyback rate cut by one of the state’s largest utilities would halt their growth.

Milwaukee-based We Energies has submitted a rate filing change to the state’s Public Service Commission that would drop the buyback rate for new customer-sited bioenergy products, like digesters that process manure and food waste, from 9.2 cents to 4.24 cents per kilowatt-hour.

The amount utilities pay for the methane gas is critical in the financial viability of the emerging use of the digesters in Wisconsin and nationally.

The surge in digesters began in 2001 when the state started its Focus on Energy program. It required utilities to obtain 10 percent of their energy from renewables — wind, solar, bio gas — by 2015. Consequently, manure digesters have been popping up across the state.

Wisconsin now has 34, the most in the nation, with two more scheduled to begin operating by 2015. In the digesters, bacteria eat biomass like manure, food scraps or whey and emit energy in the form of methane gas.

“No dairy farm or food processor can make the economics of generating electricity from bioenergy work at such a low rate,” said Tyler Huebner, executive director of ReNew Wisconsin. “This rate is guaranteed to stifle new bioenergy development in We Energies’ territory.”

If approved by the PSC, the new rate would apply to new digester projects beginning Jan. 1, 2016. Most existing digesters have 10-year contracts with We Energies. The new rate will not impact those customers until the contracts end.

ReNew Wisconsin said there are five existing bioenergy digesters connected to We Energies: the Forest County Potawatomi Digester in Milwaukee, Green Valley Dairy in Shawano, Clover Hill in Campbellsport, Volm Farms in Addison and Crave Brothers in Waterloo.

Cathy Schulze, a We Energies spokeswoman, confirmed We Energies has five customers under its current buyback rate but would not confirm the specific customers. She said each of the customers has a 15-year contract, with most expiring in a decade. “They were already aware this rate would not be continued,” Schulze said.

She said We Energies is cutting the rate because customers that generate some of their own power also use the grid in order to sell excess power that is not used on their own property. Since the power grid is paid for and used by all customers, “we contend that those other customers should only have to pay a comparable market rate for that power.”

For example, the two digesters on the Crave Brothers’ farm produce enough methane gas to power the farm, a cheese factory and an additional 300 homes, said owner Charles Crave. The remaining energy is sold to We Energies by Clear Horizons, the owners of the digesters.

Crave said utilities are looking to make money in the renewable energy market, and We Energies is no exception.

We Energies owns the state’s two largest wind farms, Glacier Hills Wind Park and Blue Sky Green Field, Schulze said. She said the utility also has invested $1 billion in renewable energy, including the wind farms and a biomass plant in Rothschild.

“What the utility is doing is snookie. It’s sneaky and underhanded,” Crave said. “Why would they want to give others those green dollars when they can get the money themselves?”

Lawmakers had an opportunity to expand the program earlier this year but the Democratic-sponsored bill died in the Republican-controlled Legislature.

Consequently, some digester owners are flaring off, or burning, the methane gas emitted from digesters because it cannot be processed or sold.

Others are searching out partners to make deals. Take La Crosse-based Gundersen Health Systems. It owns two digesters in Dane County, the final two of 10 renewable energy projects that are part of the company’s lofty 2008 plan to move off the power grid and achieve energy independence in six years, or by the end of this year.

When the two digesters in Dane County reach full production capacity later this year, Gundersen will hit the mark.

For the next five years, Madison Gas and Electric is buying back 1.5 megawatts of power from Gundersen’s community digester in Springfield for more than 11 cents a kilowatt hour. Through a separate contract with Gundersen for the Springfield digester, MGE is buying back the remaining half megawatt at 6 cents a kilowatt hour.

Dane County essentially traded some of its renewable energy credit with MGE to make the project financially viable for Gundersen.

“That agreement made the math work for Gundersen,” said Dane County Executive Joe Parisi in a July Cap Times article. “That deal needed to be made to make the digester happen.”

Murray Sim is executive vice president of Clean Energy of North America, an energy consulting and project development company for large biogas and natural gas projects.

He said third-party investors are looking to spend “billions on renewable projects” across the country and the uncertainty in Wisconsin is putting the state at a competitive disadvantage.

“What you have in Wisconsin is a story that started before We Energies. What you have is uncertainty created by the Public Service Commission,” Sim said. “The PSC has not come out strongly to say that third-party owned generation is OK. Wisconsin is missing out on a significant industry trend and customers are paying more for energy because of it.”

Read the article at the Capital Times.

by jboullion | Aug 5, 2014 | Uncategorized

Utility Proposes Anemic Buyback Rate for New Customer-Sited Bioenergy

Press release issued by RENEW Wisconsin, 8/5/2014

Contained in Milwaukee-based We Energies’ pending rate filing is a proposal to cut the buyback rate for new customer-sited bioenergy projects by more than half, down to 4.24 cents per kilowatt-hour (kWh) beginning in January 2016. The proposed rate would also apply to existing biodigesters once their existing power purchase contracts with We Energies expire.

Currently, We Energies pays about 9.2 cents per kWh for electricity generated from biogas produced from dairy cow manure or food wastes, and that rate remains in effect for the first 10 years of that system’s operation. We Energies’ biogas rate, along with similar rates offered by other utilities, was instrumental in building up bioenergy’s strong presence in Wisconsin. However, We Energies discontinued its special biogas offer several years ago, as have other utilities.

“Biogas generation provides tremendous benefits to Wisconsin,” said Tyler Huebner, RENEW Wisconsin’s Executive Director. “Biogas provides another revenue stream to dairy operations to offset fluctuations in milk prices. It helps Wisconsin keep energy dollars in the state, because we send $16 billion a year out of Wisconsin to pay for energy when we can make more of it here at home. It helps clean up our environment by reducing phosphorous at the source. The list goes on and on.”

According to RENEW Wisconsin, a renewable energy organization intervening in We Energies’ rate case, the 4.24 cents/kWh rate is a key part of We Energies’ ambitious plan to undermine the economics of customer-sited renewable energy systems through a combination of low power purchase prices and onerous charges. The Public Service Commission will review the utility’s proposal and make a decision on it before the end of this year.

“No dairy farm or food processor can make the economics of generating electricity from bioenergy work with such a low rate,” said RENEW Wisconsin executive director Tyler Huebner. “This rate is guaranteed to stifle new bioenergy development in We Energies’ territory.”

“Moreover, dairy operations with existing generating units may have no choice but to discontinue producing electricity when their current contracts with We Energies expire,” Huebner said. “The gas will either be put to a less financially attractive use or simply flared off.”

“There is no compelling rationale for a buyback rate this low,” Huebner said. “Several of We Energies’ power plants, such as Valley and Rothschild, have fuel costs that exceed 4.24 cents/kWh.”

Fuel costs at Rothschild, a new biomass cogeneration plant in central Wisconsin, are averaging over 10 cents/kWh in 2014.

“Even under the 9.2 cents/kWh rate, buying electricity from operations such as Crave Brothers near Waterloo and Clover Hill near Campbellsport is less expensive than generating electricity from that plant,” Huebner said.

“We’re worried that with We Energies’ proposed acquisition of Wisconsin Public Service (WPS), this low-ball rate, if approved, will spread into prime Wisconsin dairying country in 2017. If WPS follows We Energies’ lead, this could put on-farm bioenergy development in a state of permanent contraction.”

Existing bioenergy generation systems interconnected to We Energies include Forest County Potawatomi Digester (Milwaukee, 2,000 kilowatts); Green Valley Dairy (Shawano, 1,200 kW), Crave Bros., (Waterloo, 633 kW); Clover Hill (Cambellsport, 480 kilowatts); and Volm Farms (Addison, 225 kW).

by jboullion | Jul 28, 2014 | Uncategorized

Read the Wisconsin State Journal report on MG&E’s efforts to restructure electricity rates, which, if approved, would discourage energy efficiency and solar generation on customer rooftops. However, MG&E’s rate filing fails to quantify the alleged revenue loss attributable to energy efficiency and on-site renewables.

The Wisconsin State Journal also wrote about how We Energies also faces opposition for its proposed rates. According to RENEW Executive Director Tyler Huebner, this proposal is “as drastic as any proposal nationally.”

We Energies has dropped its protest over groups participating in its rate case, something Tyler Huebner says “can [give] the best possible look at not just the costs but also the many benefits of local renewable energy.”

The rate filings presented by these utilities are “ultimately…about fairness,” according to Bill Skewes of the Wisconsin Utility Association. Matt Neumann, owner of Pewaukee-based SunVest Solar, agrees, stating “it should be the customer’s choice. It’s their property. It’s their rooftop….people should have the choice of how they want to finance things on their own property.”

Does Wisconsin really have a fair renewable energy policy? Decide for yourself.

by jboullion | Jul 25, 2014 | Uncategorized

Stevens Point City-Times ran an article this past Wednesday that articulates the current obstacles distributed solar power generation faces in Wisconsin, particularly from the major utility companies in the state.

MREA Column: Will Wisconsin Utilities Be Left in the Dark?

July 23rd, 2014

Solar power is a shining American success story. In 1954 the modern solar cell was developed by Bell Labs, and over the past 60 years as solar installations have grown, the prices have dropped dramatically – making solar affordable for more Americans. In fact, a solar electric system is installed an average of every 4 minutes in the U.S. today. Solar is popular close to home as well. According to a recent survey by UW- Milwaukee, 68% of Wisconsin residents support using more renewable energy. Solar and renewable energy (while currently a small percentage of our energy generation mix) continue to grow in deployment and have an incredibly bright future.

One group who does not share in the excitement for solar is Wisconsin’s electrical utilities. Many of our modern conveniences run on electricity, and utility companies in Wisconsin have maintained a steady, reliable electrical grid that keeps the lights on and our gadgets charged. Wisconsin currently has a regulated and monopolized utility market, and most residents are served by utilities that are investor-owned. This means the utilities need to generate revenue to keep shareholders happy; the more electricity they produce and deliver, the greater their profit. Other Wisconsin residents are served by either cooperatives (led by a member-elected board), or by municipal utilities that are run by local governments.

Read the rest of the article

here…