by RENEW Wisconsin | Mar 28, 2014 | Uncategorized

by Don Wichert, RENEW Wisconsin

1. Renewable energy is cost effective with conventional fossil and nuclear fuels

The price of renewable energy continues to decline, while the price of conventional energy (with the recent exception of natural gas) continues to increase. Customer-sited solar electric is now equal to or less than the retail cost of grid electricity in many areas of Wisconsin. Dairyland Power Cooperative and Vernon Electric Cooperative will begin purchases of power from two large solar arrays under long term contracts. Biogas to electricity is competitive or less than retail electricity for farms and solid biomass fuels out compete propane and oil in rural areas. Renewable fuels have stable, zero, or low fuel costs, that do not fluctuate like fossil fuels.

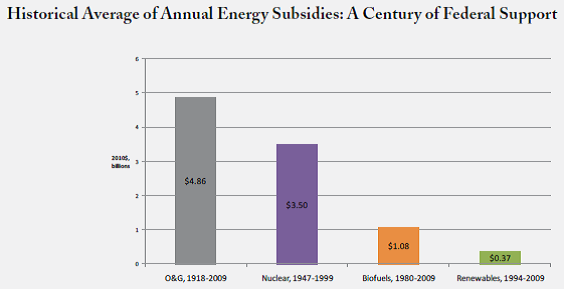

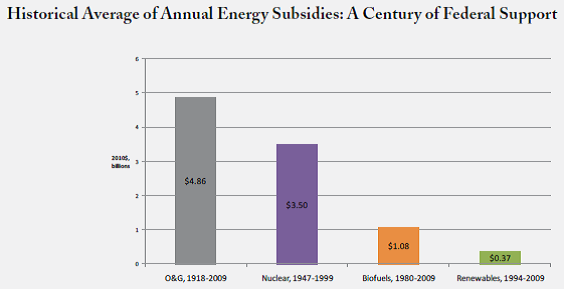

2. Fossil and nuclear industries have received more subsidies from government than renewables

All energy production in the U.S. receives significant federal support, dating back to the first oil subsidies in early 20thcentury. In cumulative dollar amounts, the oil, coal, gas and nuclear industries have received approximately $630 billion in U.S. government subsidies, while wind, solar, biofuels and other renewable sectors have received a total of roughly $50 billion in government funding.

(DBL Investors, http://bit.ly/uV14lf)

3. Wisconsin has plenty of solar energy

Wisconsin consistently receives enough solar energy to supply significant amounts of electricity used in Wisconsin households and businesses from their rooftops and properties. Wisconsin receives 20 percent more solar energy than the world’s leader in solar development, Germany, and similar amounts as New Jersey, a solar energy installation’s leader in the US. A number of studies imply that solar could supply 100 percent of Wisconsin’s electricity during peak hours by installing panels on existing roofs with solar access (http://www.ecotopia.com/apollo2/photovoltaics/PVMktPotentialCostBreakthruNavigant200409.pdf).

4. Renewable energy provides energy at critical times and locations and is matched well with other resources to maintain reliability

Solar energy output peaks in the summer when demand on the electricity system is highest due to air conditioning use. Wind power can also match high electrical demands when summer and winter winds bring in heat and cold. Biomass and hydropower are forms of stored solar energy that can be used to fill in supply gaps from intermittent sources. Natural gas plants can be quickly started as an adequate and clean back up source of power. Renewable energy systems can be installed at weak voltage locations in the transmission grid to boast power. Installation of incremental amounts of renewable energy to meet growing local demand can occur in months rather than in the years it takes for fossil fuel plants to be installed.

5. Net metering adds value to the grid and all customers

Net metering uses the electric transmission grid to absorb extra renewable electricity from distributed producers and provides a similar amount of electricity back when electric demand exceeds renewable supply. Net metering adds value when produced during peak electrical demand hours, reduces the need for transmission and distribution infrastructure, reduces environmental emissions, enhances energy security, and hedges the variable nature of fossil fuels prices. Although all customers pay for the electrical grid, studies have shown that the extra value from the renewable production is greater than the cost.

6. Wind power provides local energy, improved environmental & economic impact

Wisconsin has thirteen wind farms varying in size from 1.3 MW to 162 MW with a total of 647 MW. This represents about half of all wind energy used in Wisconsin, the rest coming from neighbors Iowa and Minnesota. This power is local, has no emissions, and is now one of, if not the, lowest sources of electricity in Wisconsin and the Midwest (http://www.awea.org/Resources/Content.aspx?ItemNumber=5547).

7. Biogas takes pollution and converts it to rural energy, jobs, and environmental improvements

Wisconsin’s 1.3 million dairy cows produce a great deal of manure: 16 billion gallons per year. For years this manure was spread on pasture land in the summer and winter. Unfortunately, some of the nutrients, pathogens, and smell polluted the local water and air sheds. Wisconsin’s 40-50 farm and food bio digesters take manure and high organic content food wastes and convert these pollutants to local energy, fertilizer, high value bedding, while reducing pathogens and smell by over 95 percent (http://www.epa.gov/agstar/documents/gordondale_report_final.pdf). In addition, the remaining digestate, which is the liquid left over from the digesters, can be stored and used in irrigation systems to add water and nutrients to crops at optimal times.

8. Biomass energy reduces greenhouse gas and other emissions, and can be grown sustainably

Biomass is “young” stored solar energy. Through photosynthesis, water is combined with carbon dioxide to form hydro-carbon compounds. Depending on the biomass, the stored carbon is one to 100 years old. In a natural system of growth and decay, all of the biomass would eventually go back to the atmosphere as carbon dioxide or methane as the biomass oxidizes (rots), if not used. Converting the biomass for productive energy reduces the total carbon emissions because it replaces old (fossil) carbon that has been stored in fossil fuels for millions of years. In addition, half of a tree’s mass is in the roots and some of the carbon is taken up by surrounding soils and stored there.

The vast majority of modern biomass combustion units are labeled, highly efficient, and are regulated for air emissions. This includes residential wood stoves. Most biomass energy processes only use wastes from non-energy forest or crop applications. Smaller branches, twigs, and leaves are not taken for energy use and contain most of the nutrients, which are recycled into the soils on the forest floor. Residual ash from the combustion process, which contains valuable nutrients, can be reapplied to the land.

9. Renewable energy is becoming more mainstream everyday

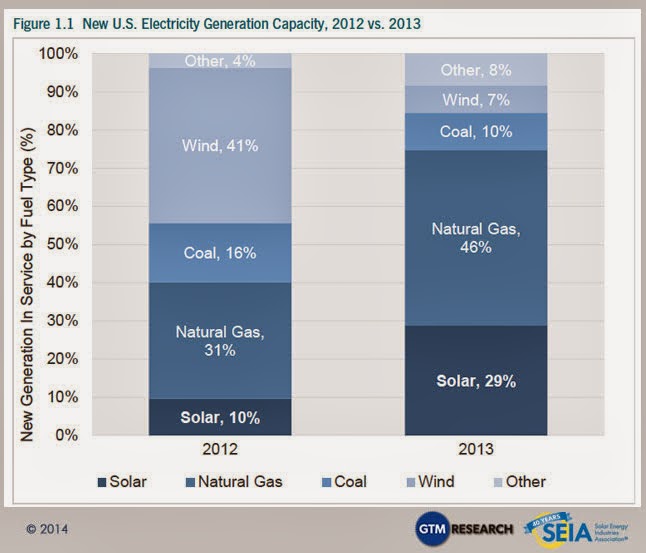

In 2012 and 2013 solar and wind supplied 51% and 37%, respectively, of all new electric generation capacity in the US (wind power additions fell in 2013 as a result of the expiration of the production tax credit).

Renewable energy now produces more power than nuclear energy in the US.

Solar energy grew at a 40% rate in 2013 from 2012. Wind energy has over 60,000 Megawatts of installed capacity, a ten-fold increase from 10 years ago.

10. The vast majority of Wisconsin citizens want more renewable energy

Surveys consistently show that Wisconsin citizens prefer renewable energy over fossil fuels. Over 83% of Wisconsin voters support solar, wind, and hydro as their energy source vs about 50 percent for coal and nuclear (Source: Voter attitudes towards Energy Issues in Wisconsin, 2012).

by RENEW Wisconsin | May 9, 2013 | Uncategorized

by Michael Vickerman

Though equipped

with a license to operate for an additional 20 years, the Kewaunee nuclear power

station rode into the sunset this week, having generated its final

kilowatt-hour. Dominion Resources, the Virginia-based company that owns the 550

MW facility along Lake Michigan, plans to spend nearly $1 billion to

decommission the facility and transform the acreage back to its former status

as farm fields. The process could take as long as 60 years.

It’s more

than a little odd to see a 39-year-old nuclear plant taken offline in a state

that’s replete with middle-aged fossil units. But in this story, age and fuel

type matter less than the extremely unfavorable market structure confronting an

independently owned baseload plant in the Upper Midwest, especially one lacking

a power purchase agreement.

Back in

2005, when the Kewaunee plant was sold to Dominion, the prevailing expectation

among Wisconsin electricity stakeholders was that sales and revenues would

never stop growing. They were convinced then that there would be room for every

new power station on the drawing boards or under construction. But when reality

intruded in the form of a nasty economic contraction, electricity loads headed

downward.

Just

after the peaking of electricity sales in 2007, an unusually large wave of new

generating units came online, including a mammoth 1,235 megawatt (MW)

coal-fired plant just south of Milwaukee. (More about the Elm Road station

later.) In a flash, the once roomy environment for power plants vanished,

leaving in its wake a glutted field of generators trying to stay afloat in a

shrinking pool of revenues.

Wholesale

electricity prices in the Upper Midwest are set in accordance with a

generator’s marginal cost of energy. Without a captive rate base to underwrite

safety upgrades and relicensing expenses, Dominion desperately needed a power

purchase agreement to have any chance to operate Kewaunee at a profit.

But the

utilities, who have their own middle-aged generators plants to protect, were

not about to throw a lifeline to Kewaunee. Recognizing an opportunity to thin

the generation herd without having to write down one of their own assets, they

decided to let brute economics administer the coup de grace to an unwanted

competitor.

As a

baseload plant, Kewaunee was poorly adapted to compete in a depressed market.

Nuclear power plants operate pretty much at one speed–full throttle—and end up

producing the same quantity of electricity at 2:00 AM, when the wholesale price

of electricity in the Upper Midwest is often below the cost of production, as

they do at 2:00 PM, when the prevailing price is at or above production cost.

Unfortunately

for a generator like Kewaunee, there are more off-peak hours than on-peak hours

in a year. When baseload plants compete in a market that does not cover the

marginal cost of operations, they tend to hemorrhage money.

Ten years

ago, baseload generators were touted as the firewall that would protect

ratepayers against price gouging orchestrated by unscrupulous power marketers

like Enron. Today, we have a diametrically opposed dynamic. In a chronically

depressed market, baseload generators are the ones in greatest need of

additional ratepayer outlays to sustain them.

This

point merits much more discussion than can be squeezed into this column, as it

signals the emerging obsolescence of the traditional utility business model.

Suffice it to say that we can now appreciate baseload generation as a luxury

made affordable by rapid load growth rates that allow the investment in

capacity expansion to be spread over a larger population of ratepayers. Sustained load growth encouraged utilities to

capture economies of scale by building centralized power plants and running

them flat out over many decades. This growth was essential for driving power

prices lower through much of the previous century.

But when

loads stop growing, the operational inflexibility of a large coal or nuclear

plant becomes a liability. Unlike a gas-fired turbine, a baseload coal plant

cannot be ramped up and down without incurring wear and tear. And, unlike a

solar electric array, a baseload generator cannot turn itself off at night,

when wholesale energy prices fall through the floor.

Nowhere

is this situation more evident than with Elm Road, the aforementioned coal

plant owned mostly by Milwaukee-based We Energies. With a price tag of $2.3 billion, this twin-unit

leviathan was the most expensive construction project in Wisconsin’s history.

And how

has it performed to date? In 2012 , its first full year of operation, Elm Road

produced only 18% of its rated capacity, roughly one quarter of its projected

output for that period. By comparison, We Energies’ newest wind power

installation, Glacier Hills, logged a capacity factor of 27% in 2012.

In March

2013, the most recent month in which utilities have reported their production

data, Elm Road’s capacity factor dropped to an abysmal 8%, the lowest

percentage among We Energies’ mainstay generators. Indeed, a hypothetical 1,235

MW solar farm in We Energies territory would likely have outproduced Elm Road

that month, recurring spells of cloudy weather notwithstanding.

Now, if a

new building was unable to achieve a 20% occupancy factor in its first year,

the building owner would face a stark choice: find more tenants or let the

banks take over. Similarly, if an airline found itself struggling to fill more

than one of every five seats in a given route, it wouldn’t take long for management

to cut back on the number of flights or cancel service between those airports altogether.

Unlike

the hypothetical airline or building owner, the parent companies that own Elm

Road are sitting pretty, because they can count on receiving monthly lease

payments that will, over a 30-year period, recover the capital sunk into that

plant, along with a tidy double-digit return on investment. Those lease

payments are now embedded in utility rates, whether Elm Road is cranking out

the kilowatt-hours or gathering dust.

The same

market conditions—low natural gas prices and depressed demand–that hastened

Kewanee’s retirement are partially responsible for Elm Road’s breathtakingly

poor performance to date. But the plant’s difficulties are exacerbated by its massive

size and its operational inflexibility.

There are

likely a few hours in every weekday when market prices rise high enough to

bring an Elm Road unit online. The trouble is, Elm Road is not equipped to

cycle like a gas-fired plant just to cover a few afternoon hours. When those

situations arise, the system operator dispatches a smaller, more flexible

generator that can do the job, even if Elm Road’s unit energy cost is nominally

lower. So Elm Road just sits there, consuming electricity instead of producing

it.

There is

simply not enough market space right now in Wisconsin to accommodate a large

newcomer like Elm Road at anywhere near its rated capacity, even after

Kewaunee’s departure. Until the generation herd thins out some more, Elm Road’s

utility to the ratepayers who are picking up the tab for this monumental

misallocation of investment capital will remain virtually nonexistent.

The

lessons from Kewaunee and Elm Road are clear: building baseload plants belongs

to a bygone era. The older ones are fraught with legacy costs, while the newer

ones carry burdensome financial risks. Those states that manage to avoid the

choking levels of overcapacity we have in Wisconsin have plenty of room to

stake out an aggressive clean energy development program going forward.

by RENEW Wisconsin | Apr 26, 2013 | Uncategorized

from Michael Vickerman

In addition to unwanted snow showers, April 2013 has brought us a flurry of clean energy news stories. Taken together, these recent developments offer a revealing picture of the unique challenges we face in Wisconsin in advancing an energy future that is less reliant on fossil fuels.

On the face of it, the announcement on Earth Day that several Wisconsin utilitie will retire a minimum of 260 MW of older coal-fired plants and spend $1.2 billion on pollution control upgrades should qualify as good news. The settlement with U.S. EPA also obligates Wisconsin Power & Light (Alliant Energy) and Madison Gas & Electric to offer up to $5.5 million to support solar PV installation in their territories.

However, if one does the math, the solar component adds up to only one-half of one percent of the total amount the utilities will spend under this settlement. The price tag of the pollution control work even exceeds the nearly $1 billion it will cost to decommission the soon-to-be-retired Kewaunee Nuclear Power Plant. That 39-year-old plant will cease operating in May.

With a combined price tag exceeding $2 billion, these will very likely be the two most expensive electricity-related projects initiated this decade. Ratepayers will absorb the full cost of the pollution control measures undertaken by the owners of the Columbia and Edgewater power plants.

If Kewaunee’s retirement and the planned shutdowns of Alliant’s Nelson Dewey and Edgewater 3 plants had been announced five years ago, Wisconsin would be swarming with wind and bioenergy developers right now. But utility interest in renewable energy development has diminished markedly, owing to the unfavorable political climate here for windpower development and the belief that natural gas will stay cheap for years to come. Furthermore, electricity providers have largely fulfilled their requirements under Wisconsin’s modest Renewable Electricity Standard, and there is no successor policy in sight.

Don’t get me wrong. We are elated that up to $5.5 million will be set aside for new solar electric generating capacity. But that sum is insufficient to remedy the massive imbalance in Wisconsin’s electricity resource mix. Even when being shuttered for good, Wisconsin’s legacy coal and nuclear plants seem destined to cast a long shadow over our energy future and draw resources away from building a less fossil-fuel-intensive energy economy.

Contrast these stories with two recent developments in Iowa. First, Facebook announced that it will locate a brand-new data center near Des Moines. There were many ingredients that led to the selection of Iowa as a data center host, not least of which is a substantial in-state wind energy portfolio that help keep Iowa electricity rates well below the national average.

The other milestone was a recent Circuit Court decision that moves Iowa tantalizingly close to the day when electricity customers can freely contract with third parties to provide them with renewable energy produced on their premises. If this becomes an explicit policy in Iowa, the solar energy market should mushroom there, as it has in states like New Jersey, California and Colorado.

Natural gas prices are just as low in Iowa as they are here, but you won’t find the utilities there using that as an argument against investing in renewables. In the case of Facebook, ongoing renewable investments helped seal the deal. The social media giant is hungry for wind generation, and Mid-American, which has ample supplies of windpower, is hungry for new customers with large energy appetites.

A similar dynamic could evolve in Wisconsin, but the state’s utilities need to understand how valuable clean energy is to attracting companies and industries to set up shop here.

by jboullion | Feb 8, 2013 | Uncategorized

Update: 2/14/13 Michael Vickerman was interviewed on this topic by Thomas Content of the Journal Sentinel. Read his comments here.

###

This article by Richard Ryman in the Green Bay Press Gazette explains that area legislatures are trying to count nuclear energy as renewable energy… A truly unacceptable concept. Take action through Clean Wisconsin, and tell your legislator that this is wrong:

A bill to make nuclear energy produced in Wisconsin count toward the state’s renewable energy standard was written with Kewaunee Power Station in mind, but likely won’t keep that plant from closing this spring.

A bill to make nuclear energy produced in Wisconsin count toward the state’s renewable energy standard was written with Kewaunee Power Station in mind, but likely won’t keep that plant from closing this spring.

Dominion Resources Inc. has said it will shut down the one-reactor power plant on the shore of Lake Michigan in the spring because it could not sell it and cannot operate it profitably. Kewaunee’s power-purchase agreements with Wisconsin Public Service Corp. and Alliant Energy expire in December 2013, leaving the plant without a sure source of revenue.

A new agreement could not be reached because natural gas-generated electricity is cheaper than nuclear-generated power. The lack of an agreement made the plant unattractive to potential buyers.

Reps. Andre Jacque, R-De Pere, Garey Bies, R-Sister Bay, and Paul Tittl, R-Manitowoc, drafted the bill, called LRB-0527, and are seeking co-sponsors.

As written, the bill would apply only to Kewaunee Power Station now, though it could apply to Point Beach Nuclear Plant or a new nuclear plant — none are planned — in the future. Point Beach has contracts to sell electricity that expire in 2030 for Unit 1 and 2033 for Unit 2 and would be ineligible for the bill’s benefits until those contracts expire.

“It is forward looking,” Jacque said. “If we had passed this legislation five years ago, in my opinion, we wouldn’t be seeing Kewaunee close.”

As long as natural gas prices remain at historically low levels, the tradeable resource credits created by the bill would not be enough to make nuclear competitive. Also, most Wisconsin utilities are near or have met their renewable-energy requirements.

“With the current environment of inexpensive natural gas, even though well intentioned, this bill may not have much impact,” said Kerry Spees, spokesman for Wisconsin Public Service Corp. “However, the current environment could change. We support the bill’s efforts to create jobs.”

Jacque said natural gas likely will not always be so inexpensive.

“There is a whole lot of uncertainty regarding fracking. It depends on what the EPA decides to do,” he said. “(Natural gas) is a bubble, just like any number of bubbles can occur.”

Hydraulic fracturing, or “fracking,” is the process of drilling and injecting fluid into the ground at a high pressure to fracture shale rocks to release natural gas inside. Many environmental groups oppose fracking.

The bill does not reclassify nuclear power as renewable energy. It adds an “advanced energy” category to the ways in which utilities can meet their mandated requirements. Utilities are required to have 10 percent of their electricity generated by renewable sources by 2015.

Nuclear power was not included in the renewable energy standards originally, but Jacque said he’s heard no objections to his proposal so far from environmental groups.

Read on…

Take action and email your legislatures through Clean Wisconsin.

by jboullion | Nov 9, 2012 | Uncategorized

A commentary by Michael Vickerman, Director, Policy and Programs at RENEW Wisconsin:

Shock waves reverberated across the Upper Midwest when Dominion Resources announced in late October that it would permanently shut down its Kewaunee nuclear generating station in early 2013. Operational since 1974, the Kewaunee station, located along Lake Michigan 30 miles east of Green Bay, currently generates about 5% of the electricity that originates in Wisconsin.

Virginia-based Dominion, which bought the 560-megawatt Kewaunee plant in 2005 from two Wisconsin utilities, attributed its decision to its inability to secure long-term power purchase agreements to keep the plant going. Without securing purchasing commitments from utilities, Dominion would have to sell Kewaunee’s output into the regional wholesale market at prices well below the plant’s cost of production.

While the pricing environment for all bulk power generators is nothing short of brutal these days, Kewaunee carries the additional burden of being an independently owned power plant, since the entities most likely to buy electricity from that generator—utilities–have power plants of their own that compete for the same set of customers. And a growing number of these utility-owned generators burn natural gas, which is currently the least expensive generation source in most areas of the country.

Dominion’s decision comes down to simple economics. Wisconsin utilities believe that over the foreseeable future natural gas will remain cheap and supplies will remain abundant. That would explain their unwillingness to enter into long-term commitments with Dominion, even though Kewaunee recently acquired a 20-year extension to its operating license and does not need expansive retrofits to comply with environmental standards, unlike a host of utility-owned coal plants in Wisconsin.

But even if Dominion’s managers were convinced that natural gas prices have nowhere to go but up in 2013 and beyond, the company, lacking a retail customer base in the Midwest, could not risk producing power below cost while waiting for the turnaround.

Wisconsin utilities have placed heavy bets on natural gas in the expectation that it will remain the price-setting fuel for years to come. Over the last 12 months, they have bought several combined-cycle generators from independent power producers. Buying power plants enables them to pass through their acquisition and operating costs directly to their customers while generating returns to their shareholders. I suspect these utilities are anything but broken up over the impending demise of a nonutility competitor that could have supplied electricity to Wisconsin customers for 20 more years.

But there is another side to this story; the low-price energy future that Wisconsin utilities are embracing can only materialize if natural gas extraction companies continue to sell their output below production costs. This expectation is unrealistic, given the massive pain being inflicted on these companies in the form of operating losses, write-downs, and credit rating downgrades.

Don’t just take my word for it, ask Exxon Mobil ceo Rex Tillerson, whose company spent $41 billion during the shale gas boom to acquire XTO, a large gas producer that is now yielding more red ink than methane. As reported in a recent New York Times article, Tillerson minced no words in assessing the impact of its recent misadventures on the company’s bottom line. “We’re all losing our shirts today,” Tillerson said. “We’re making no money. It’s all in the red.”

Much of the industry’s woes are self-inflicted. The lease agreements that drillers eagerly signed during the height of the shale gas boom obligate them to extract the resource by a certain deadline, regardless of whether such activity is profitable. That these companies cannot disengage quickly from existing leases is greatly diminishing their appetite for exploring new natural gas prospects. Until a pricing turnaround occurs, they will refrain from spending money on exploring new resource provinces like Ohio and Michigan.

Sooner or later, this slowdown in exploration activity will tip the supply-demand equation in the opposite direction, resulting in lower-than-average gas storage volumes. Barring a repeat of last winter’s unusually mild weather, the crossover point should occur around January 1st . But with so many balance sheets in tatters from this highly unprofitable market environment, nothing short of a strong and sustained price increase will be required to persuade drillers to start taking risks again.

When this corrective price increase begins rippling through the electricity markets, it will be interesting to observe how the customers will respond. Right now Wisconsin utility managers are convinced that they are making the right call on natural gas. So completely have they swallowed the shale gas “game-changing” mystique that they were willing to let a 560 MW nuclear plant fall out of the supply picture for good. In this brave new world of theirs, gas is the new coal, and resource diversity is passé.

In the aftermath of Dominion’s announcement, a few commentators have defended the impending closure as a textbook example of how markets work. But this view ignores the delusional thinking that sent shale gas extraction into overdrive, causing prices to plunge below the cost of production. The real game-changer, as it turns out, here was not the emergence of “fracking” technology but the industry-generated public relations campaign that implanted the narrative of a nation awash in cheap natural gas into virtually every American cranium. But as we now see, this narrative has boomeranged on the natural gas industry, and they are paying for their current woes in ways that guarantee a pronounced pendulum swing in the direction of higher prices.

The question going forward is: will this narrative also boomerang on Wisconsin electricity users, after the last employee leaving Kewaunee turns out the lights?

Michael Vickerman is program and policy director of RENEW Wisconsin, a sustainable energy advocacy organization. For more information on the global and national petroleum and natural gas supply picture, visit previous posts Madison Peak Oil Group’s blog: http://www.madisonpeakoil-blog.blogspot.com. This commentary is also listed on RENEW Wisconsin’s blog: http://www.renewwisconsin-blog.org/